KUALA LUMPUR 27 October 2017. EPF announced that effective 1 July 2018 members who contribute voluntarily to their EPF accounts either through the 1Malaysia Retirement Scheme SP1M Self-Contribution or the Top-Up Savings Contribution can now do so in any amount as the requirement to contribute a minimum RM50 at.

What Is The Epf Contribution Rate Table Wisdom Jobs India

Whether you are formally or informally employed there is an option for you.

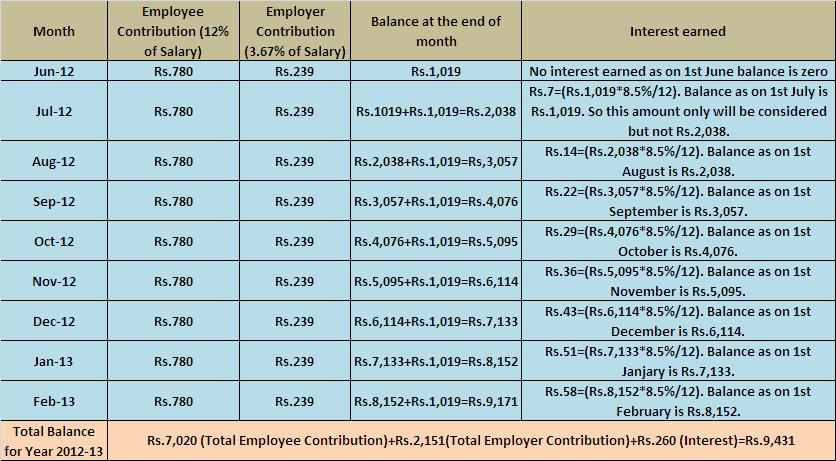

. The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private. The Central Board of Trustees administers a contributory provident fund pension scheme and an insurance scheme for the workforce engaged in the organized sector in India. Interest on the EPF contribution for April Nil No interest for the first month Interest on the EPF contribution for May 4700 0675 31725.

Find out how you can grow your savings today. Anyone can contribute to EPF to grow their retirement savings. April 14 2021 at 841 pm.

1 June 2018 subject to a minimum of Rs. It may be noted that Expenditure incurred by EPFO in administering the Provident. Notification dated 9th April 1997 was issued enhancing Provident Fund contribution rate from 833 to 10.

Hope the above helps. Contribution on wages higher than the statutory wage limit is dealt under Para 266. Because theres a matching incentive of 15 up to RM250 per year for EPF i-Saraan contribution from the year 2018 until year 2022.

Moreover the interest is calculated monthly but transferred to the Employee Provident Fund account only on 31st March of the applicable. The reduction was announced in 2016 after the tabling of the revision of Budget 2016 by PM Datuk Seri Najib Razak. This would effectively mean higher take away salary for women employees Jaitley said in his budget speech.

The EPF Contribution Rate for the financial year 2021 is 85. Under the EPF Scheme 1952. In the union budget 2018-2019 new women employees can make an EPF contribution of 8 instead of 12.

It is a scheme managed under the Employees Provident Funds and Miscellaneous Provisions Act 1952 by the Employees Provident Fund Organisation EPFO. September 2 2020 at 711 pm. Flexible Voluntary Contribution Effective 1 July 2018.

WSU612019Income TaxPart-I E-333064581 dated 06042022 78MB 6. Effective January 2018 cycle February 2018 EPF contribution the statutory contribution rate for employees share will revert to the original 11 for members below age 60 and 55 for those aged 60 and above. Besides EDLI Admin charges have already been waived wef.

Indexing and Preparation of Documents for Archival of Employees Provident Fund Department of the Central Bank of Sri Lanka. February 1 2018 at 1040 am. 01-04-2017 10 rate is applicable for Any establishment in which less than 20 employees are employed.

January 2018 salarywage up to December 2018 c. Report 2016 Tables 2016. PF Admin charges have been further reduced from 065 to to 05 applicable wef.

Employee Provident Fund Contribution Rate Over The Years. Assuming the employee joined service on 1st April 2021 contributions start for the financial year 2021 2022 from April. Economic Survey 2017-18 had pointed out that women participation in the countrys total workforce has come down to.

The Employees Provident Fund EPF is a savings tool for the workforce. Joint option of employee and employer is to be submitted and the same is required to be accepted bv EPFO. Annual General Transfer AGT 2022 - Calling for online options through the HR-Software logins of officers.

The Board is assisted by the Employees PF Organization EPFO consisting of. Employees Provident Fund- Contribution Rate The EPF MP Act 1952 was enacted by Parliament and came into force with effect from 4th March 1952. With this 172 categories of.

Besides the EPFO Act will be amended to reduce contribution of women to 8 from 12 with no change in employers contribution. Employers are required to remit EPF contributions based on this schedule. You are so helpful.

75 in the case of functional non-functional organisations. Presently the following three. Most of us know or at least heard of EPF Employees Provident Fund which is also known as KWSP.

As per this Para for provident fund contribution on higher wages. The interest rate is decided after discussion between the Central Board of Trustees of EPFO and the Ministry of Finance at the end of every financial year. The current EPF interest rate for the Financial Year 2021-22 is 810.

Given below is a list of interest rates of some of the previous years-. Calculation and deduction of taxable interest relating to contribution in a provident fund exceeding specified limit HO No. The Employees Provident EPF lauds the Governments announcement to provide more incentive to the retirement well-being of the informal sector workers who are not covered by a formal or holistic system of social protection.

During the tabling of Budget 2018 Prime Minister Datuk Seri Najib Razak announced that the. The EPF contribution rate for the financial year 2021 is 85. Given below is a list of interest rates of some of the.

Thank you so much. Cancel reply Leave a Comment. This privilege is only for the first three years of employment.

EPF Contribution Schedule Third Schedule The latest contribution rate for employees and employers effective January 2019 salarywage can be referred in the Third Schedule EPF Act 1991 click to download. In other words the new interest rate announced will be valid from 1st April of one year to the year ending on 31st March of next year. Relocation of Current Contribution Division and Statemented Contribution Division and Introduction of revamped official.

How Epf Employees Provident Fund Interest Is Calculated

Epf Contribution Rate For Employee And Employer In 2019 Planmoneytax

Budget 2018 Epf Contribution By Women Employees Reduced To 8 From 12 Mint

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

Epf Contribution Rates 1952 2009 Download Table

Epf Historical Returns Performance Mypf My

Epf Interest Rate From 1952 And Epfo

Epf New Basic Savings Changes 2019 Mypf My

Epf Interest Rate From 1952 And Epfo

For Affluent Epf Is Not Nest Egg But Goose That Lays Golden Eggs The Hindu

Epf Contribution Rates 1952 2009 Download Table

Pf Contribution Rate From Salary Explained

Epf Rules For Employer 2018 19 Registration And Contribution Planmoneytax

Basics And Contribution Rate Of Epf Eps Edli Calculation

20 Kwsp 7 Contribution Rate Png Kwspblogs

Number Of Active Epf Members And Contributions Download Table

Epf Contribution Rate 2022 23 Employee Employer Epf Interest Rate